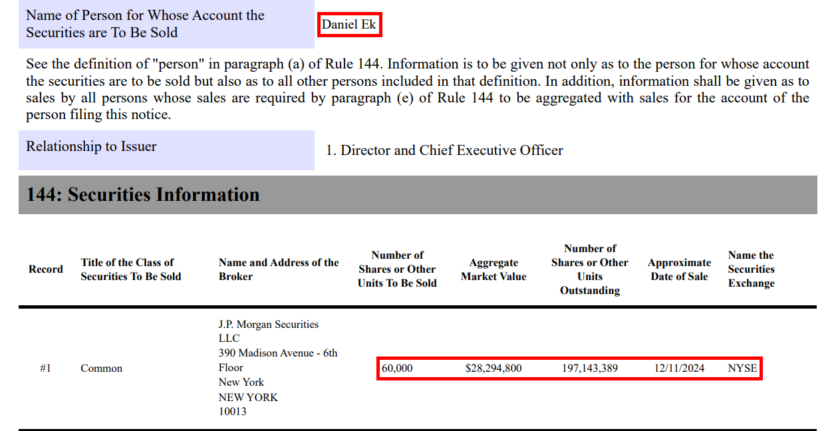

Spotify’s CEO Daniel Ek has once again cashed out a substantial amount of stock, taking home $28 million from the sale of 60,000 shares. This is a result of a significant surge in Spotify’s stock price, which recently peaked at an all-time high of $502.38 per share, helping the company reach a market cap of $100 billion. Ek’s decision to sell is for obvious reasons and part of a larger trend among Spotify’s key stakeholders. Several other executives are also taking advantage of the company’s soaring stock prices. Resulting in over a billion dollars of Spotify stock traded in 2024 within the company itself.

More details on Spotify elites and their stock trading

Daniel Ek’s 2024 stock sale marks the continuation of a larger and consistent pattern of stock trades. Despite these sales, Ek remains a major shareholder, holding roughly 15.65% of Spotify’s total stock. Spotify’s co-founder Martin Lorentzon has also made significant sales, offloading nearly 1.5 million shares for over half a billion dollars. Chief Product Officer Gustav Soderstrom and Chief Business Officer Alex Norstrom are doing the same thing. They have similarly sold off portions of their holdings, benefiting from the substantial rise in Spotify’s stock price. In summary, the stocks themselves have jumped by more than 500% since November 2022.

How CEOs Get Paid

For CEOs of major companies, stock options are one of the ways they make their large paychecks. Stock prices are often tied to the performance of the company and can result in significant payouts. While Ek’s stock sales are substantial, they are part of a broader trend in corporate compensation. Leaders are incentivized to drive their companies’ market value upwards to reap financial rewards. In many cases, stock options are both a motivational tool and a way to align the interests of executives with those of shareholders.

Summary

Spotify’s remarkable stock performance in 2024 has allowed its top executives to reap substantial financial gains. Daniel Ek’s latest $28 million sale is just one example of the wealth that has been generated within as Spotify continues to grow in both revenue and market cap. As the streaming giant moves forward, it’s clear that stock incentives will remain a crucial part of how its leadership is compensated, and for other CEOs, this model continues to be a key driver of financial success.